Jyoti CNC Automation IPO Release Date: Friends, in article we will review the first IPO of 2024, the IPO of Jyoti CNC Automation, which will be open between January 9 and January 11.

Table of Contents

First of all, we will see its gray market premium, this will give us an idea of the listing gains, then we will know about the details of this company, what work does this company do, which sector is the company in, how can its future be, then its financials and We will know the fundamentals, is the company a profit making or a loss making company and is it expensive or cheap compared to its peer competitors? We will know all these things, then we will know about the details of this IPO and finally we will know whether we should apply for this IPO, or you should not do it and if you do then do it according to listing gains or long term, we will clear all the things in this video.

Highlights of the IPO issue of Jyoti CNC Automation Ltd

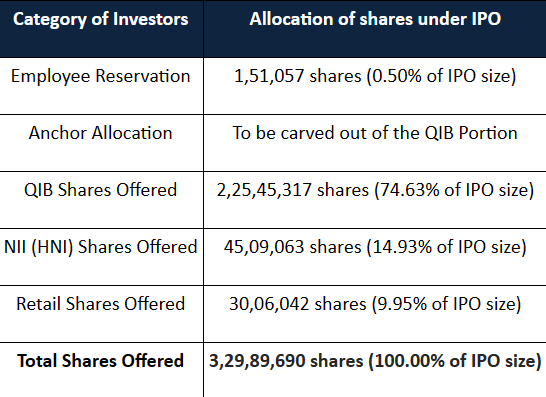

- 3,02,11,480 shares (302.11 lakh shares roughly) are being issued as part of Jyoti CNC Automation Ltd‘s new issue component of its IPO. At the top price range of ₹331 per share, this translates to a fresh issue size of ₹1,000 crore.

- The Jyoti CNC Automation Initial Public Offering (IPO) is scheduled to take place between January 09, 2024, and January 11, 2024. The stock of Jyoti CNC Automation IPO has a face value of ₹2 per share. The book building IPO has a price band of ₹315 to ₹331 per share, and the final price will be determined by the book building process.

- Jyoti CNC Automation Ltd’s initial public offering (IPO) will consist solely of a new share offering without an offer for sale (OFS) component. As you are aware, an OFS is merely a transfer of ownership and does not involve dilution of equity or EPS, whereas a fresh issue typically brings in new funds into the company but also dilutes EPS.

- As an additional feature of the overall IPO of Jyoti CNC Automation Ltd, the issue of 3,02,11,480 shares (302.11 lakh shares approximately) will be included in the total IPO size of ₹1,000 crore, as there is no offer for sale (OFS) and the fresh issue portion will double as the overall issue size.

GMP Today

Friends, first of all, if we talk about the gray market premium, the latest gray market premium that I am telling you now, the gray market premium keeps going up and down according to the demand, so the latest gray market premium is ₹ 100 per share means 45, this is a lot of 45 shares, so it is worth Rs. 4500 but look at all the IPOs that have come recently whose GMP was doing very well but the listing was down a lot, so keep this thing in mind now, think a little about the meaning of GMP. Don’t trust it completely, friends, its anchor list will come.

Jyoti CNC Company Details

Friends, this company was incorporated in 1991, so it is almost 32 years old company, which means it has good experience in its sector. And friends, this is a Rajkot based company. It is a company of Rajkot, mostly Machining Engineering is done in Rajkot. There is more work.

Full form of CNC machine is Computer Numeric Control, meaning this machine is operated by computer. There is automatic machine type, one is manual operate. What happens inside manual operate, it is called lathe machine. What happens inside lathe machine that any There is metal etc., it has to be cut, it has to be shaped, there are many things inside it, turning, mylin cutting, all these things are inside it, any metal is big, cutting them, giving shape, that work is done by the lathe machine. Is.

Apart from Aerosmith, big aerospace companies are its clients and many companies of the automotive sector are its clients. It also has clients from India and from outside also. It has a total of three manufacturing units, two inside Rajkot and one in France. Inside means outside also and apart from this, it manufactures total 200 types of CNC machines in total 44 series and it is the second or third largest CNC machine manufacturer in India, inside its website it is written that it is second largest and 12th largest. It is the largest in the whole world, it comes at 12th position in the whole world, which means it has a very good position in the field of CNC machine manufacturing etc., which means it is a leading company in its sector, this is a good thing and in the field of CNC machines in India, which is its The market share is around 8 per cent, so its sector seems good, it seems demanding, its client base is good and it is ranked among the leading companies, so it is a good thing for it and from the automotive sector, which means it generates revenue. Arrowsmith is around 46. Now its financials and fundamentals.

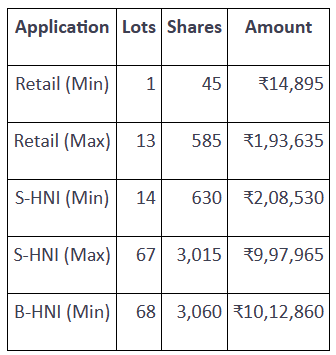

Lot Size of Jyoti CNC Automation IPO

Jyoti CNC Automation Limited Financial Information

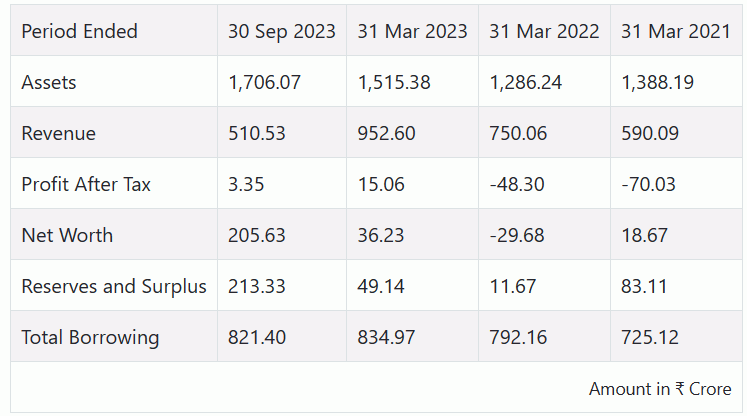

Friends, we know its financials are given from 2021 to 2023, so if we look at its assets, we are seeing growth in its assets year after year, so this is a good thing. Then friends, if we look at the revenue, then there is growth in the revenue also year after year. The growth is like one and a half times growth from 2021 to 2023, although the growth is less but it is okay, its growth is like one and a half times growth. Then talking about its profit after tax, there seems to be a little problem here, that is, it is making profit within f5 23. There is very little profit coming in. Just how much profit margin is there? The profit margin is only at 1.5%.

The profit margin is very less because it does the manufacturing itself, so the minimum profit margin should be between 8 to 15%, then it would be good. Yes, it is only % and although it was a loss making company in the last years, this also seemed to me a little negative point and what is more, if there is profit, then generate profit for two-three years, after that I think it would be better to bring IPO.

So, you should have waited a little, I am telling you what I personally feel, then its net worth has become positive this year, then after this the ridge cash is worth Rs 213 crores and its another big problem is the debt on top of it. Borrowing is very high, borrowing is increasing every year, it has decreased a little this year, there is borrowing of Rs. 821 crores and its debt to equity ratio is above 10, which means it has a lot of debt, so this is the biggest negative point for me in this company. Regarding I told you that its financials look a bit weak.

Jyoti CNC Automation IPO Apply or Not

So first of all, according to the listing gains, should one apply for this IPO or not? So see friends, GMP is running well right now, above 20, but now we should wait and see the market sentiment. Let the anklet list come first and second day. Look at the subscription, how is the demand and make the decision accordingly because you see the last IPO, GMP was doing great but what is the matter that the listing happened to be very down because one should not have full faith in GMP, it is just an estimate, go ahead with an estimate, more things.

Don’t look at the financial fundamentals, keep all the things in mind and then make the decision. Right now we feel it is better to wait. Rest see friends, you have to take the decision considering your own risk and analysis. Then friends, is this IPO good for the long term? If you should apply or not, then you can see both its positives and negatives, so that you will understand, so the first thing is what is inside the positives, then its sector is very good, that means the sector which manufactures CNC machines etc.

Is very good. And it is the leading company in its sector, second largest in India, 12th largest company in the entire world, which means it has clients inside India as well as outside India in manufacturing CNC machines. Two manufacturing facilities inside India, one in France, one inside Rajkot. There is a manufacturing facility inside, so this is a positive point.